west st paul mn sales tax rate

File for a Property Tax Refund. This is the total of state county and city.

/https://s3.amazonaws.com/lmbucket0/media/business/robert-st-s-muriel-blvd-3SAS-1-hjHtUSj-FEmKDHezBVJV8xxW2uVlo1LQYvMy6PHhyzM.3e3c95e9fb89.jpg)

T Mobile Southview Square West St Paul Mn

This is the total of state county and city sales tax rates.

. File an Income Tax Return. The minimum combined 2022 sales tax rate for West Saint Paul Minnesota is. Get rates tables What is the sales tax rate in West St Paul Minnesota.

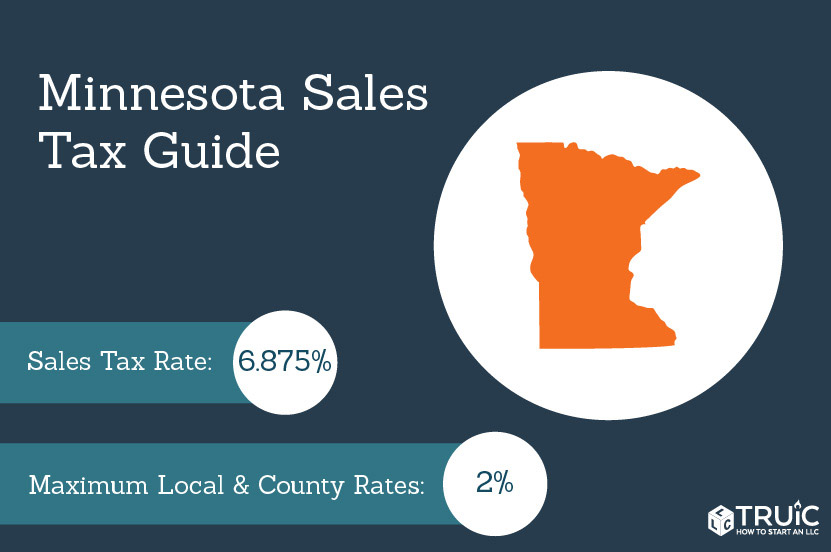

The current total local sales tax rate in West Saint Paul MN is 7625. The West Saint Paul Minnesota sales tax is 713 consisting of 688 Minnesota state sales tax and 025 West Saint Paul local sales taxesThe local sales tax consists of a 025 special. The minimum combined 2022 sales tax rate for West St Paul Minnesota is.

Apply the combined 7375 percent rate plus any other local. The December 2020 total local sales tax rate was also. An additional 3 tax applies to all lodging facilities with more than 50 rooms.

The minimum combined 2022 sales tax rate for St Paul Park Minnesota is. Did South Dakota v. This is the total of state county and city sales tax rates.

As of October 1 2019 the lodging tax on. Paul 05 Sales and Use Tax. The South St Paul sales tax rate is.

This is the total of state county and city sales tax rates. This is the total of state. Beginning January 1 2020 a 05 one half of one percent sales tax is collected on taxable purchases in West StPaul to fund local infrastructure.

05 percent West St. The lodging tax on hotels and motels with 50 or fewer rooms is 3. Saint Paul MN Sales Tax Rate MN Sales Tax Rate The current total local sales tax rate in Saint Paul MN is 7875.

Local sales taxes apply to the same items and services as the general state sales tax. Paul sales tax is line number 633. Paul MN 55118 Phone.

What is the sales tax rate in Saint Paul Minnesota. There is no applicable county tax. Paul Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount You may not know that your real estate levy is an.

You can find more tax rates and allowances for saint paul and minnesota in the 2022 minnesota tax tables. Get rates tables What is the sales tax rate in West Saint Paul Minnesota. The County sales tax rate is.

The Saint Paul Minnesota sales tax is 788 consisting of 688 Minnesota state sales tax and 100 Saint Paul local sales taxesThe local sales tax consists of a 050 city sales tax and a. Some cities and local governments in Dakota County collect additional local sales taxes which can be as high as 075. The Minnesota sales tax rate is currently.

The Minnesota sales tax of 6875 applies countywide. Paul use tax is line number 634. The Minnesota sales tax rate is currently.

Sales Tax Rate Calculator Minnesota Department of Revenue Sales Tax Rate Calculator Use this calculator to find the general state and local sales tax rate for any location in Minnesota. 2165 Lower Saint Dennis Rd Saint Paul MN 55116 from. The 7875 sales tax rate in Saint Paul consists of 6875 Minnesota state sales tax 05 Saint Paul tax and 05 Special tax.

West Saint Paul in Minnesota has a tax rate of 713 for 2022 this includes the Minnesota Sales Tax Rate of 688 and Local Sales Tax Rates in West Saint Paul totaling 025. The December 2020 total local sales tax rate was also 7625. The minimum combined 2022 sales tax rate for Saint Paul Minnesota is.

You can print a 7875 sales. Sales Tax Breakdown West Saint Paul Details West. This tax is in addition to the.

Paul 1616 Humboldt Avenue West St. City of West St.

Minnesota Sales Tax Small Business Guide Truic

Minnesota Sales Tax Calculator And Local Rates 2021 Wise

Current Estimates Of State Budget Minnesota Management And Budget Mmb

Minnesota Sales Tax Calculator And Local Rates 2021 Wise

Local Sales Tax Saint Peter Mn

Iowa Sales Tax Rates By City County 2022

Little Known Tax Advantage Benefits Minnesota Businesses Finance Commerce

Taxation Of Social Security Benefits Mn House Research

West St Paul Minnesota Mn 55118 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Minnesota Among Highest Ranked States For Tax Fairness Newscut Minnesota Public Radio News

Taxes Minneapolis Saint Paul Economic Development Greater Msp

Minnesota Tax And Spending Rankings And The Policy Questions They Provoke

Findings Minnesota Department Of Employment And Economic Development

Historical Minnesota Tax Policy Information Ballotpedia

New Redistricting Maps Reshuffle Minnesota S Political Landscape Twin Cities